If you’ve ever applied for finance – and we mean any kind of financial contract such as a postpaid mobile phone, car rental, or up to something as huge as a home mortgage, whoever you’re dealing with will ask you if you consent to a credit enquiry. These are also commonly known as a credit check. What is a credit check or credit enquiry? How does it work? We answer all that and more in this easy to read and understand blog post.

Your credit history

Everyone in Australia, if they’ve interacted with the banking system in some way (so that really is everyone!) will have a credit history. These histories are kept by one of three (or all three) firms authorised by the government to be credit reporting bodies.

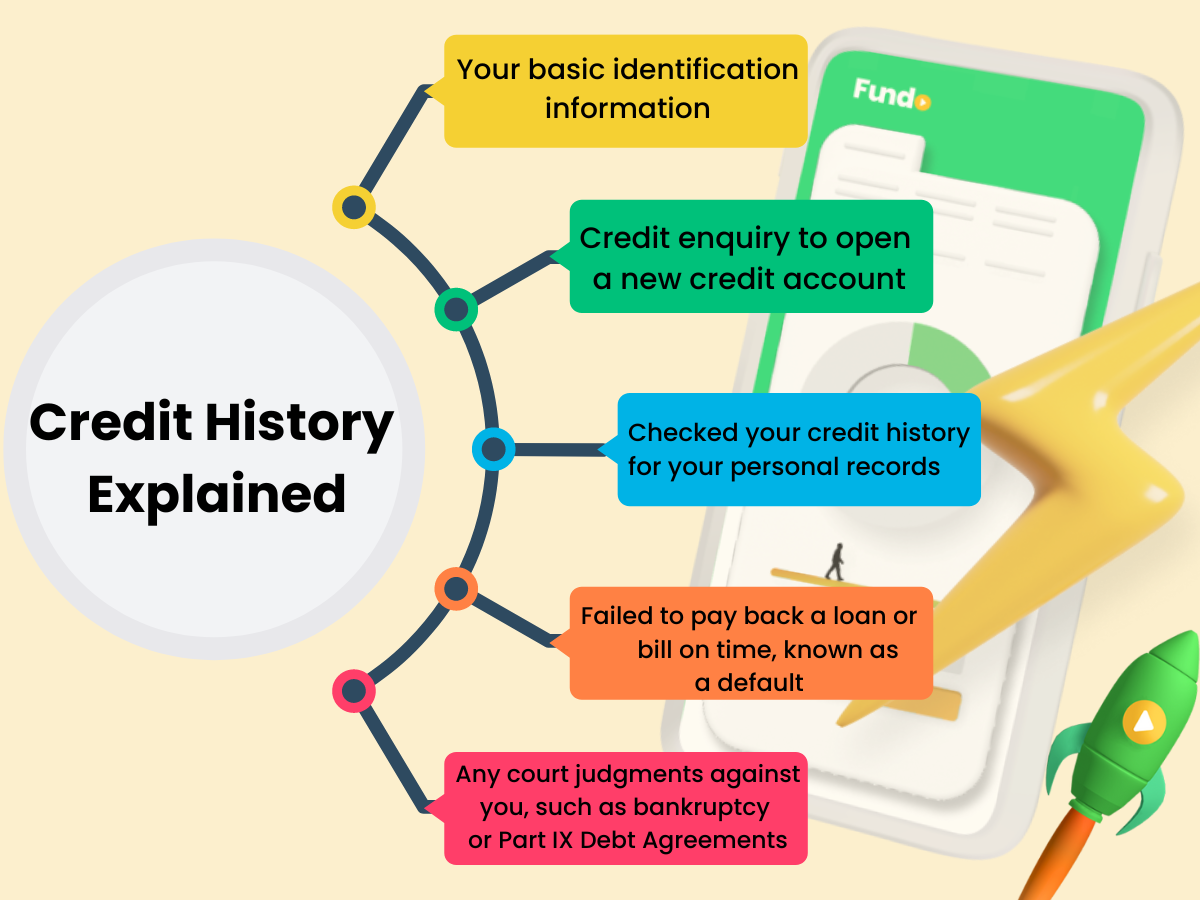

Your credit history is a record of:

- Your basic identification information

- Times when you consented to a credit enquiry to open a new credit account

- Checked your credit history for your personal records

- Failed to pay back a loan or bill on time, known as a default

- If you have any court judgments against you, such as bankruptcy or Part IX Debt Agreements

In addition to this information, bodies also use “comprehensive credit reporting” which also details what credit you’ve used in the past two years (credit cards and the like), your credit limits, how much you repay each billing period, and if it’s been on time or not.

When you consent to a credit check, the business is looking at this history to confirm who you say you are and whether you can afford to take out a loan or not.

All this information is bundled up and expressed as a score, known as your credit score.

Credit scores and credit eligibility

Credit scores are like a “back of the envelope” or “at a glance” look at your creditworthiness, or ability to pay back a loan on time and in full without going into hardship. You will have a credit score that ranges between zero and 1000 (sometimes 1200.)

The higher your score, the more likely you are to get approved for loans and with more favourable rates. The lower the score – and anything below “average” is known as bad credit, which makes approvals more difficult to get – and if you are approved, you may have to pay higher than average interest rates due to banks seeing you as a higher risk.

Accredited lenders with an Australian Credit Licence are businesses authorised to check a person’s credit history. Some lenders may not check your credit score or credit history to figure out if you are eligible, like Fundo. More on that later.

What credit enquiries tell you (and lenders)

If you have a high amount of credit checks or enquiries, it can indicate you are trying to take on more debt too quickly, which could mean you are in some kind of financial trouble. This may not show the full picture – it only shows when you’ve applied, and not why.

You should also check your own credit score, which you can do every three months for free (or if you’ve been refused credit within the past 90 days). This can show you if there are any mistakes on your credit history, which are your responsibility to clean up. It can also show if you’ve fallen victim to identity fraud, as there may be consents to credit checks you didn’t personally allow. You can check your credit every three months for free. Get started at the Office of the Australian Information Commissioner.

FAQs

Can I get a Fundo loan without a credit enquiry?

Yes – we understand you may need cash fast in an emergency and the last thing you want is another credit enquiry on your history. We’ve got you – and can approve applicants who may have bad credit and don’t want to consent to another credit check.

How much can I borrow without a credit check?

At Fundo, you can borrow anywhere between $500 to $5,000 without a formal credit enquiry. Your Fundo dashboard will show you how much you are eligible for based on our own eligibility requirements and the information you provide us.

How long do defaults and judgements stay on my credit history?

Defaults and judgments against you are recorded in your credit history for up to seven years. In that time, it may be difficult to gain finance – even a mobile phone contract – though you can try to repair your credit score and history by demonstrating good financial conduct through keeping debts to a minimum.

Is my Fundo Score the same as my real credit score?

No – Fundo’s scoring system is an internal scoring method that is entirely separate from the scores kept by credit reporting bodies. Fundo immediately rewards you for paying off loans on time and in full. It can take months or weeks for your credit score to go up or down – and sometimes paying off a loan will temporarily lower your bureau credit score! We make everything transparent on your Fundo dashboard – and hopefully a bit of fun!

I’m afraid someone has stolen my identity. What can I do?

If you have obtained your credit history and notice many credit checks or applications that you didn’t make, you need to contact your banks, lenders, and the credit reporting bodies immediately. You should freeze your credit history, which blocks all incoming inquiries. You may also need to replace your identification (e.g., driver licence numbers) to prevent further fraud.

Knowledge is power – knowing your credit score before you apply for credit could help you repair your history or score, meaning higher chances of approval with better interest rates! The advice presented here is general in nature. Please contact a financial adviser or professional before making any financial or credit decisions.