In the first half of 2024, 143,106 Australians reported over $137.12 billion in losses to scams according to the National Anti-Scam Centre. As times are tough at the moment with the cost of living, scammers prey upon the vulnerable with loan scams, investments scams, “too good to be true” buying or selling scams, and other financial fraud designed to give criminals money they absolutely don’t deserve. If you’re looking for a loan and want to be wary of scams and being ripped off, read this post about all the latest scams, how to avoid them, and how to keep yourself and your family safe from scams!

Identifying a scam and scammers

Unfortunately, every one of us with an email address or a phone number has likely had their brush with a scam. You may have seen a dodgy “bank” email riddled with misspellings (and probably not from an institution you have an account with) or received a phone call from someone insisting that you owe money to the Australian Taxation Office (although when pressed, they can’t even name the current Federal Treasurer.) Some of these scams are obvious to detect – or so it seems.

In the age of Generative AI (ChatGPT and the like) scams and scammers are becoming more and more sophisticated. According to the Australian Banking Association, in 2023, Australians fell prey to an average of 25,148 scams a month, worth $39.7 million every month.

So how can you identify scams and scammers in this day and age? Fortunately, the nature of scams doesn’t change: the aim of the scammer is to trick you into giving them your personal information (phishing), money, or both.

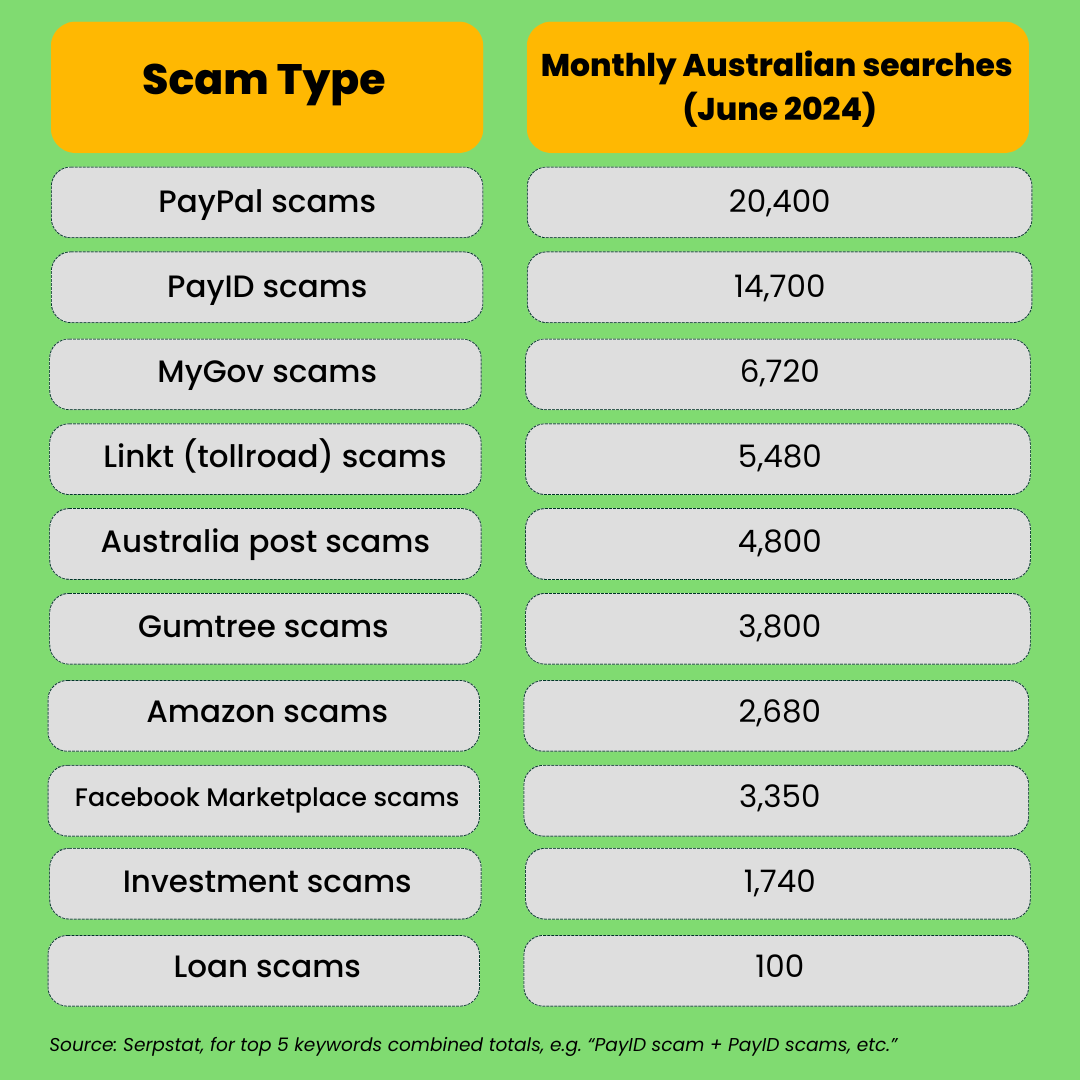

Monthly searches for scam types in Australia

Phishing scams

These scams are usually “phishing” scams – trying to get your personal information first to impersonate you somewhere else. Phishing usually leads to identity theft – once they have your name, address, licence/passport number, etc., scammers can use your information to open up bank accounts, take out loans, apply for credit cards, etc, all in your name. An email or text message pretending to be your bank or other institution such as PayPal will ask you to “verify your account” or “verify a transaction” by clicking a button or link. Don’t be fooled – financial institutions in Australia do verify accounts this way. Here is how you can check if an email may be a scam:

- The email addresses you as “Sir/Madam,” or “Valued customer” – anything but your real name, which is information PayPal, your bank, or other site would normally have.

- The domain name does not match the website, e.g. a PayPal email doesn’t originate from example@paypal.com.

- The links in the message don’t point towards an authentic domain, e.g. commbank.com.au if they’re purporting to be the Commonwealth Bank.

- Incorrect designs (they may be using old logos), misspellings, bad grammar, etc.

PayID scams

PayID or Osko is an Australian interbank financial service introduced in 2018 that allows for instant transfers of money between banks (and helps us at Fundo place money into your account when approved!) The origin of the fraud begins with a misunderstanding of how PayID works – scammers ask you to supply your PayID (usually a phone number or email address) and then insist on the following:

- You don’t have “Premium PayID” or “PayID Plus” and you need to pay for this to enable the transaction. PayID is free to use, and any extra money you send will be taken by the scammer.

- The scammer will send more than the stated price, saying they made a mistake. By the time you refund them the difference, you will also be on the hook for the entire amount as they had no money to begin with. This is also an example of a “refund” scam.

- These are often seen on online marketplaces, where a buyer will accept the stated price for your goods, sight unseen. Legitimate buyers will want to view the item before buying.

Gift card scams

Gift card scams are more common over the phone, as scammers pose as Amazon, Microsoft, or even a government department insisting you have bought an item, need an anti-virus subscription, or have broken the law somehow. After trying to convince you that your purchase/computer error/indiscretion is genuine, they will ask for payments in gift cards. This is how it works:

- “Amazon” will call you out of the blue “confirming a purchase” of a big ticket item such as an iPhone, or you may have encountered a fake virus notification on your PC insisting you call “Microsoft” immediately. You may also discover a voicemail on your phone, usually from a computer generated voice, saying you owe money to the ATO or police.

- Once you dispute the purchase or the scammer has intimidated you with imminent prosecution, they say they can only process your refund or accept your fine via your purchasing of large denomination ($500+) gift cards.

- They will keep you on the line and feed you lines to say to cashiers, trained to intercept gift card scams. They may have you buy smaller gift cards from various sources to avoid detection.

- Once you give them the activation codes, your money is gone.

- If you get calls like these, ignore them and block them immediately.

- Gift card scammers may pose as eBay, Centrelink, the ATO, Amazon, Microsoft, Google, and any number of major companies or government departments you may interact with on a daily basis. Again, these organisations wouldn’t call or text you in this way to gain payments.

Temu scams

Temu scams are a little more subtle than most other scams, as they lure unsuspecting buyers into buying goods that are fake, broken, poor quality, or non-existent. These shops may be fly-by-night merchants that take as many orders as possible and dispatch cheap goods that don’t live up to their lofty claims. These items are usually “too good to be true” and should be avoided. Other online marketplaces such as eBay offer an authenticity guarantee, while overseas sites like Wish.com, Temu, and Aliexpress, do not.

Linkt/toll road scams

These scams will likely arrive over text or email and will insist that your toll road (Linkt) account is overdue, or you have driven over a toll road without authorisation and are now subject to a fine. These texts or emails will usually never include your account number, registration, or any other identifying information to confirm you are the driver (or a driver of a vehicle in the first place!) They will also have:

- Links that do not originate from linkt.com.au

- Bad grammar or obvious misspellings

- The amounts you supposedly owe don’t correspond to current toll prices.

Australia post scams

These scams may come via email or text and will ask you to confirm your address, ask for additional payment for an incoming parcel, or some combination of the two. They may also ask you to “confirm” your identity using a fake social media message to organise a courier for your online marketplace listings. If you’ve received a suspicious email, invoice or text message claiming to be from Australia Post, send it to scams@auspost.com.au so they can take a closer look and/or authenticate the email.

Online marketplace scams

Online marketplace scams can target both sellers and buyers. As a seller, you may be hit with the PayID scam or the Gift Card scam. They may also send you fake receipts or invoices insisting you have the money, even though you haven’t seen it in your account yet. (Remember, PayID enabled bank accounts and PayPal are instant!) You then part with your item and never see any money for it.

As a buyer, they may target you with “too good to be true deals” for big ticket items or even major assets such as cars and rental properties. They may say they are only selling quickly due to an imminent military deployment or overseas move and need a deposit to “secure” your purchase. Once they have your money, they disappear.

- Never pay a “deposit” or “holding fee” for an item on online marketplaces.

- As a seller, insist on the buyer looking at the item first before buying. If they can’t or are evasive, walk away.

- Many scammers will use Generative AI or translation software that feels like you are talking to a robot, not a person. If you are selling a specific PC graphics card, for example, they may ask “Is the MSI Ventus AMD Radeon 6700XT 12GB good condition! still for sale?” A native English speaker – or even someone with basic English skills – wouldn’t type this out in full.

- If they ask for payment using odd payment processors you’ve never heard of or obscure cryptocurrency, walk away.

Investment or loan scams

These investment or loan scams may come from websites, social media, phone callers, or emails posing as legitimate financial institutions offering high-yield investments or super-low interest rate loans. You can avoid these types of scams by asking:

- If the lender holds a credit licence issued by ASIC, or be a representative of a licensee. You can search for the Australian Credit License number on the ASIC website to check that the provider is appropriately registered.

- If the investor or financial adviser holds an Australian Financial Services Licence.

- For the Product Disclosure Statement for the investment or loan, which outlays your rights and obligations as an investor or borrower. If they can’t or are evasive, walk away.

- If there is a prospectus or shareholders agreement, if you are investing in an asset or shares. Again, if they can’t provide one, walk away.

- Look for the business offering investments or loans online, reading online reviews and looking up their business on the Australian Business Register.

- Scammers posing as charities will also ask for money in this way. Follow the above tips as registered charities must also be registered businesses.

Scams are rife online and wherever there is money changing hands you can bet you’ll find a scammer there doing something criminal,” says Bishara Hatoum, CEO and Founder of Fundo. “Whether it’s online shopping, getting a loan, or investing, always check and double check who you’re speaking to. If something feels off, don’t hesitate to ask a friend or an expert to see if something is legitimate first. Don’t be afraid to intervene when you hear a friend or family member might be getting scammed either. It can save everyone a lot of pain – and money.

How to keep yourself safe from scams

Here is a list of things you can do right now to help protect yourself from scams. Some are simple – though you may need some help from a tech-savvy friend or family member (or assistance from a reputable technician.)

- Install anti-virus or anti-malware software on your computer or smartphone. Some apps will scan emails and SMS messages for inauthentic links and advise you to ignore them.

- Use a password manager and have different, unique, and complicated passwords for all your online accounts.

- Turn on two-factor authentication (2FA). This means you need to prove your identity twice to enter a site – e.g. inputting a time-sensitive code or approving a sign-in using biometrics.

- Install an anti-scam or anti-fraud dialler app on your phone such as Hiya, to identify potential incoming scam calls so you can avoid them as they occur.

- If you are looking for credit or finance, check that the provider or institution has an active Australian Credit Licence.

- If you are looking to buy something online that seems too good to be true, see if the website ends in .au. All .au domain names must be tied to an ABN/ACN/etc. and can be looked up on the Australian Business Register. You can find this information at the auDA Whois, auda.org.au.

- Some credit reporting bureaus (the ones who track your credit history) may provide identity protection services for a fee. They can alert you to anyone trying to access your credit file without your knowledge, so you can put a “freeze” on your file and prevent identity theft.

- Turn on biometric protection, password protection, or pattern protection on your smartphone if you haven’t already.

- Make sure your screen and phone locks when it is unattended, even for seconds at a time.

- A government department will never call you directly, nor will they ask for payments over the phone. Anyone posing as such is likely a scammer.

- If an email from a company originates from a free email service such as Hotmail, Gmail, or Yahoo! Mail, it’s likely a scam. Send it to your junk mail and do not open any links or attachments.

- Avoid swiping your card to make in-store purchases, as some devices may have what’s known as card skimmers installed, which can record your card information and enable identity theft. Tap or insert your card instead.

- Always look for the padlock icon on your browser when making an online purchase. Any website without “HTTPS” (HTTP Secure) in the URL should be avoided.

- Look at your bank statements each month – or week if possible. Watch out for any irregular transactions, especially on your credit card. Scammers may not take out hundreds or thousands of dollars; sometimes they syphon off small amounts that you otherwise wouldn’t notice. If this is the case, contact your bank immediately.

- Don’t give out any personal information on social media, even if it seems harmless, such as memes telling you “what your gangster name is” (or something similar) by lining up your birth date and birth month with funny or silly names. That information is one stepping stone towards a scammer stealing your identity.

- Change your passwords or PIN numbers regularly.

If you believe you’ve fallen prey to a scam, contact your bank and other financial institutions immediately, and report the scam to Scamwatch. If you receive an email from Fundo that doesn’t look right, please forward it on to us so we can investigate. If you’re ever in doubt about communications from Fundo, call us on 1800 131 861 during opening hours. Together, we can stamp out scams and ensure safety and security for you and your family online!

Disclaimer: The opinions expressed in the Blog are for general informational and entertainment purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific investment product. It is only intended to provide education about the financial industry. The views reflected in the commentary are subject to change at any time without notice.