Apply, approved

and funded - in minutes

Safe

and Secure. 3 min

application²

Safe

and Secure. 3 min

application²This Target Market Determination (TMD) has been prepared by Fundo Loans Pty Ltd ACN 604 639 143, holder of Australian Credit Licence 491418 ("Us, We, Our") to comply with our Design and Distribution Obligations under Part 7.8A of the Corporations Act 2001 (DDOs). It applies to our Medium Amount Credit Contract (MACC) product.

We have assessed that this product is likely to meet the likely objectives, financial situation and needs of consumers who:

We have assessed that this product is likely to meet the likely objectives, financial situation and needs of a consumer within the target market because it satisfies all the above criteria.

We consider that this product may not meet the likely objectives, financial situation and needs of a consumer who:

| Attribute | Details |

|---|---|

| Minimum Loan Amount | $2,001 |

| Maximum Loan Amount | $5,000 |

| Minimum Term | 9 weeks |

| Maximum Term | 26 weeks |

| Interest Rate | 47.8% per annum |

| Repayment Frequency | Weekly, fortnightly, monthly |

| Fees and Charges | Establishment fee of $400 |

| Distributor | Conditions and assessment |

|---|---|

| Direct distribution by Fundo |

Fundo distributes the product directly to consumers via our website. Applications are received electronically. The application form includes questions which seek to help us identify whether the applicant falls within the target market for the product. Financial data is verified via applicant-provided access to the applicant’s bank account statements. The verified data and application details are assessed against a defined set of credit assessment criteria. The following factors that are built into our application, assessment and approval process are designed to ensure that our product is distributed to customers within the target market:

Where the application satisfies all criteria for approval and the application reveals no indications that the applicant is not within the target market for the product, the application is auto approved by our Loan Management System (LMS). Where the application fails to satisfy sufficient approval criteria, it is auto declined by LMS. Applications that do not meet the criteria for auto approval or auto decline are then passed to a team of highly trained credit analysts, who assess the application against the business’ credit criteria and policies and the product target market to enable them to provide an approval or decline decision. We ensure that all material on our website is consistent with the product features and provides sufficient information about the product to enable consumers to make an informed decision about whether to apply for the product. We have assessed that this distribution channel, including the conditions, is likely to direct distribution of the product to consumers within the target market because it provides rapid and straightforward access to the loan approval process, provision of loan funds to approved applicants without delay and an assessment and approval process that ensures that the loan repayments will not place the consumer in financial hardship. |

The occurrence of one or more of the following events will prompt us to review this TMD to ensure that the TMD remains appropriate:

First review date: 31 October 2024

Periodic reviews: The TMD will be reviewed annually, with the review completed by the anniversary date of the TMD.

Trigger reviews: Review of the TMD will commence within 10 days of the date we identify a trigger event.

The following information must be provided to us by distributors who engage in retail product distribution conduct in relation to this product:

| Type of information | Description | Reporting period |

|---|---|---|

| Complaints |

Number of complaints The details of a specific complaint |

Every 3 months Within 10 business days |

| Significant dealing/s |

Date or date range of the significant dealing/s and description of the significant dealing (e.g. why it is not consistent with the TMD) |

As soon as practicable, and within 10 business days after becoming aware |

Safe

and Secure. 3 min

application²

Safe

and Secure. 3 min

application²

Safe

and Secure. 3 min

application²

Safe

and Secure. 3 min

application²

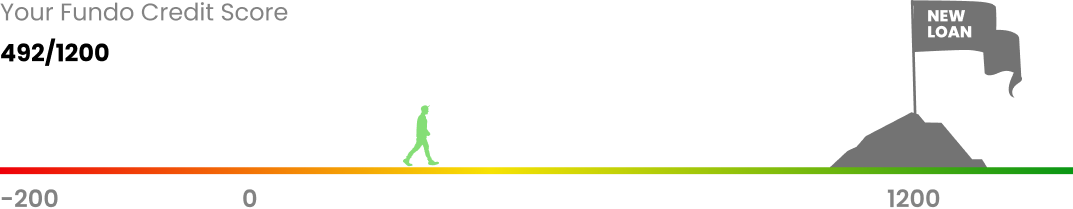

Increase your Fundo Credit Score to boost your chance of getting approved on your next loan.

Safe

and Secure. 3 min

application²

Safe

and Secure. 3 min

application²

Loan amount from $500 to $2000

Minimum 91+ days to maximum 6

months

20% establishment fee and a flat

4% monthly fee4

Loan amount from $2001 to $5000

Minimum 91+ days to maximum 2 years

$400 establishment fee, interest at

47.80% p.a. (comparison rate 66.58% p.a.)5

4 Fees are based on loan principal advanced.

5 The comparison rate is specific to a $2,500 loan over a two-year term with a $400 establishment fee and fortnightly repayments. Any deviation in loan amount, term, or additional fees and charges can result in a different comparison rate, and the given comparison rate only applies to the presented example.

6 The example assumes timely repayment as per the loan agreement, or additional fees and charges may apply.

Safe

and Secure. 3 min

application²

Safe

and Secure. 3 min

application²¹As soon as you sign your contract and if all other requirements have been met, we instantly send the funds to your nominated bank account. If your bank works with the New Payments Platform (NPP), most customers see funds in their account within 60 seconds. If your bank is not NPP enabled, or it is a weekend or a public holiday, the funds are usually received by the next business day. Fundo cannot guarantee that loan funds will be received within 60 seconds

²Applying for a loan with Fundo usually takes about 3 minutes. However, this time can change based on a few things, such as your typing speed, the device you're using, and whether you have all the necessary information ready to go.

³As the approval process is influenced by various external factors, we can't guarantee that you'll receive a decision on the same day. However, most of our customers do receive a same-day response to their application with Fundo, if they submit their loan application and all the requested supporting information by 4pm Sydney time during a regular business day.

We typically respond within 2 min or sooner.