The Fundo Score is an internal scoring system that uses advanced data analysis to help us assess your likelihood of financial hardship if a loan were to be approved. It reviews:

-

Your bank transaction data, including income, expenses, and liabilities;

-

Your history with other lenders and any repayment patterns;

-

Risk indicators such as multiple concurrent loans or high-frequency gambling activity; and

-

Your existing relationship with Fundo (if any), including past repayment behaviour.

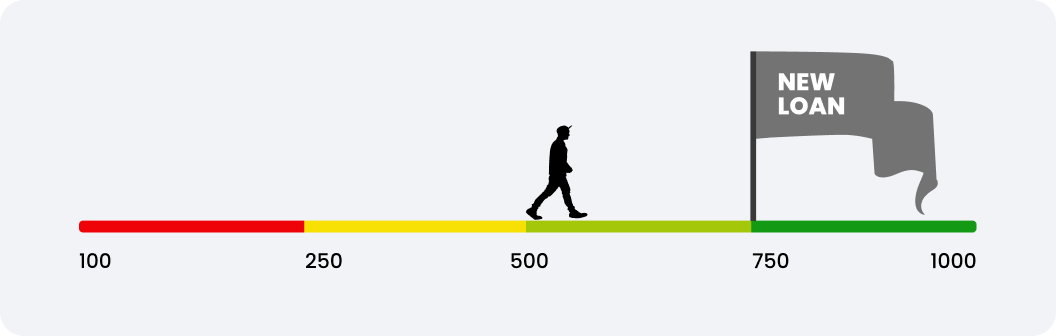

Your Fundo Score is dynamic and updated over time as your financial behaviours change. It’s designed to help you understand your risk profile and build healthier financial habits.

The higher your Fundo Score, generally the lower your assessed risk of hardship. A higher Fundo Score may improve your chances of approval with Fundo, including access to higher loan amounts.